The Credit Notes section in Billing Now allows you to issue credits or refunds related to existing invoices.

You can create a credit note linked to a specific invoice or manually for custom adjustments.

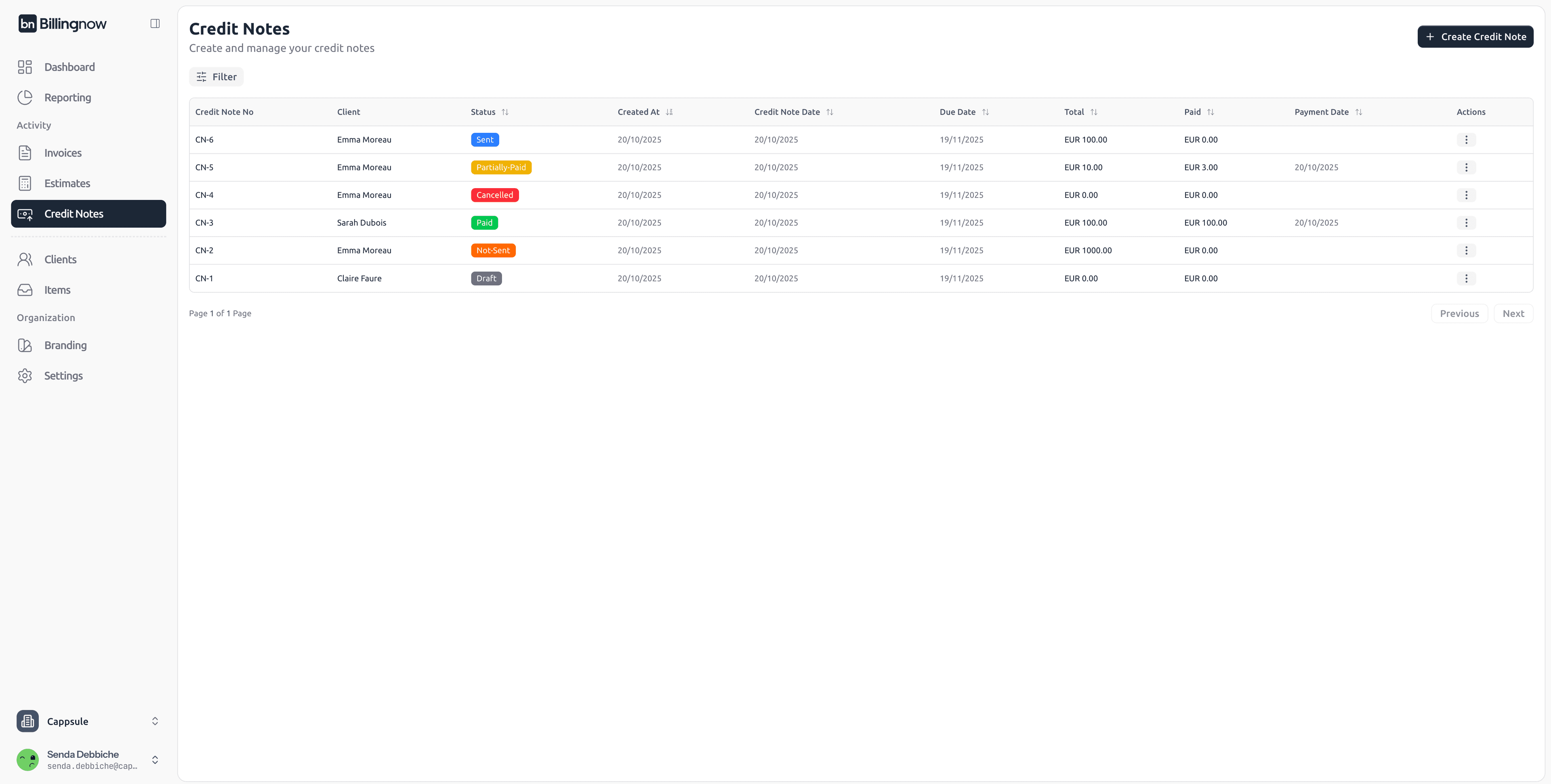

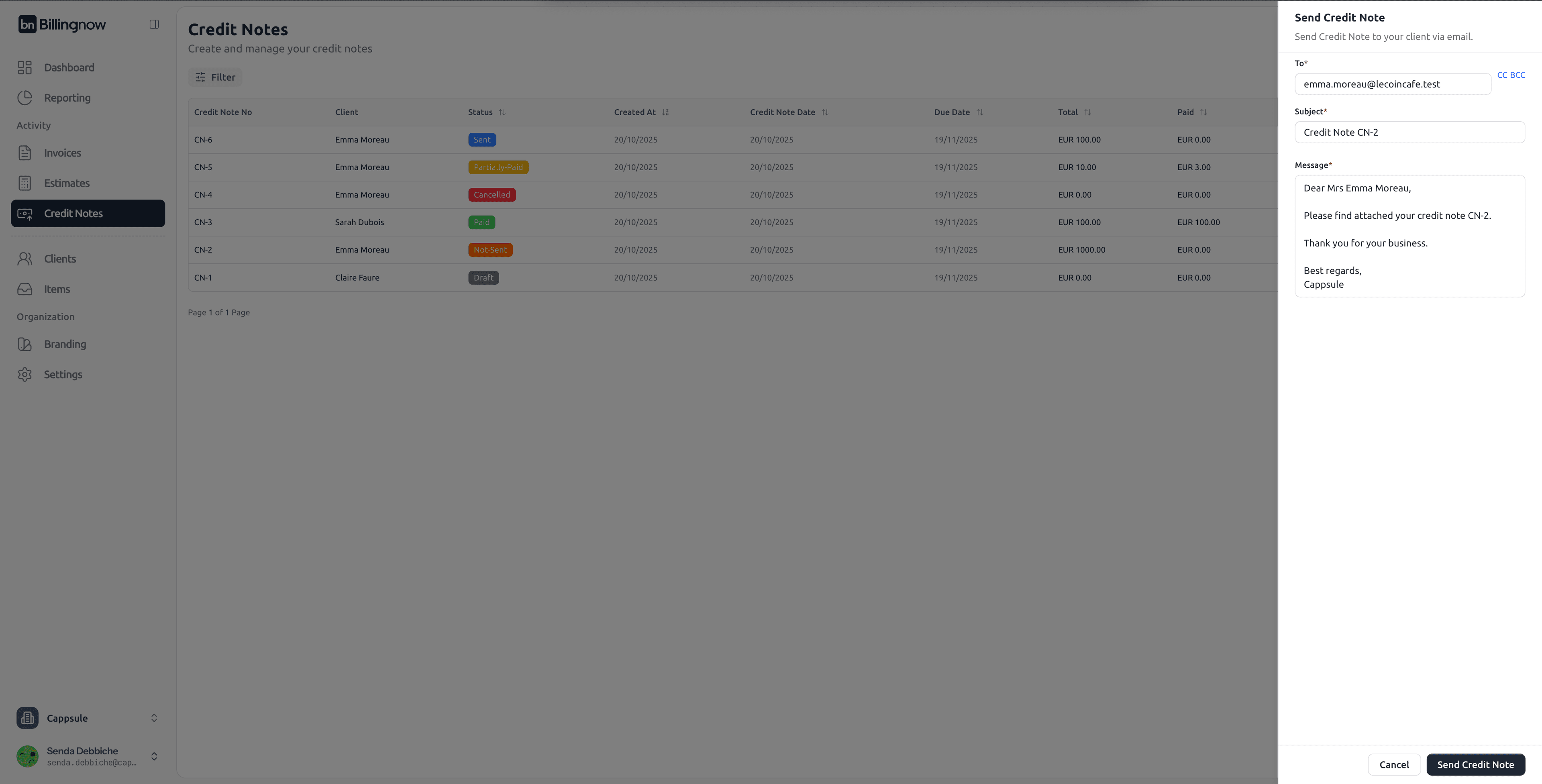

📂 Credit Note Management Dashboard

Go to Sidebar → Credit Notes

The Credit Notes dashboard lists all your credit transactions and their details.

| Column | Description |

|---|---|

| Credit Note No | Unique identifier (e.g. CN-001). |

| Client | The customer receiving the credit. |

| Credit Note Date / Due Date | Dates of issue and payment. |

| Total | Total amount credited. |

| Payment Date / Paid | Date and amount refunded (if applicable). |

| Status | Current progress (Draft, Sent, Paid, Refunded). |

| Created At | Record creation date. |

| Actions | Edit, view, delete, or download. |

⚪ Draft – Not yet finalized.

🟠 Not Sent – Finalized but not yet sent to client.

🔵 Sent – Credit note shared with client.

🟢 Paid – Fully paid credit note.

🟡 Partially Paid – Partial payment received.

🔴 Cancelled – Invalid or voided credit note.

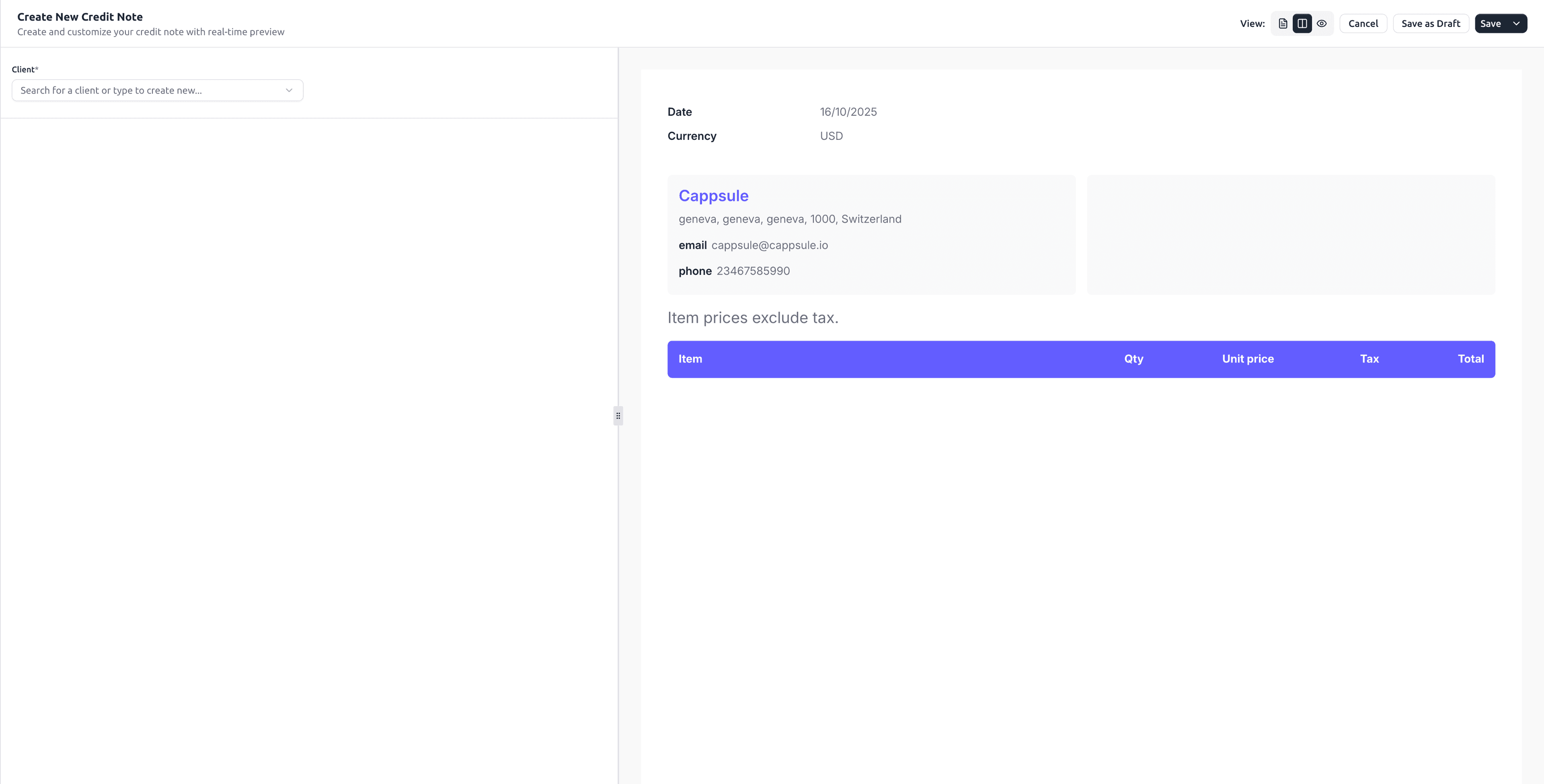

➕ Creating a New Credit Note

To create a new credit note, click the “Create Credit Note” button in the top-right corner.

🧾 Step 1: Select or Add Client

Choose an existing client from the dropdown. Or type a new client name to create one instantly.

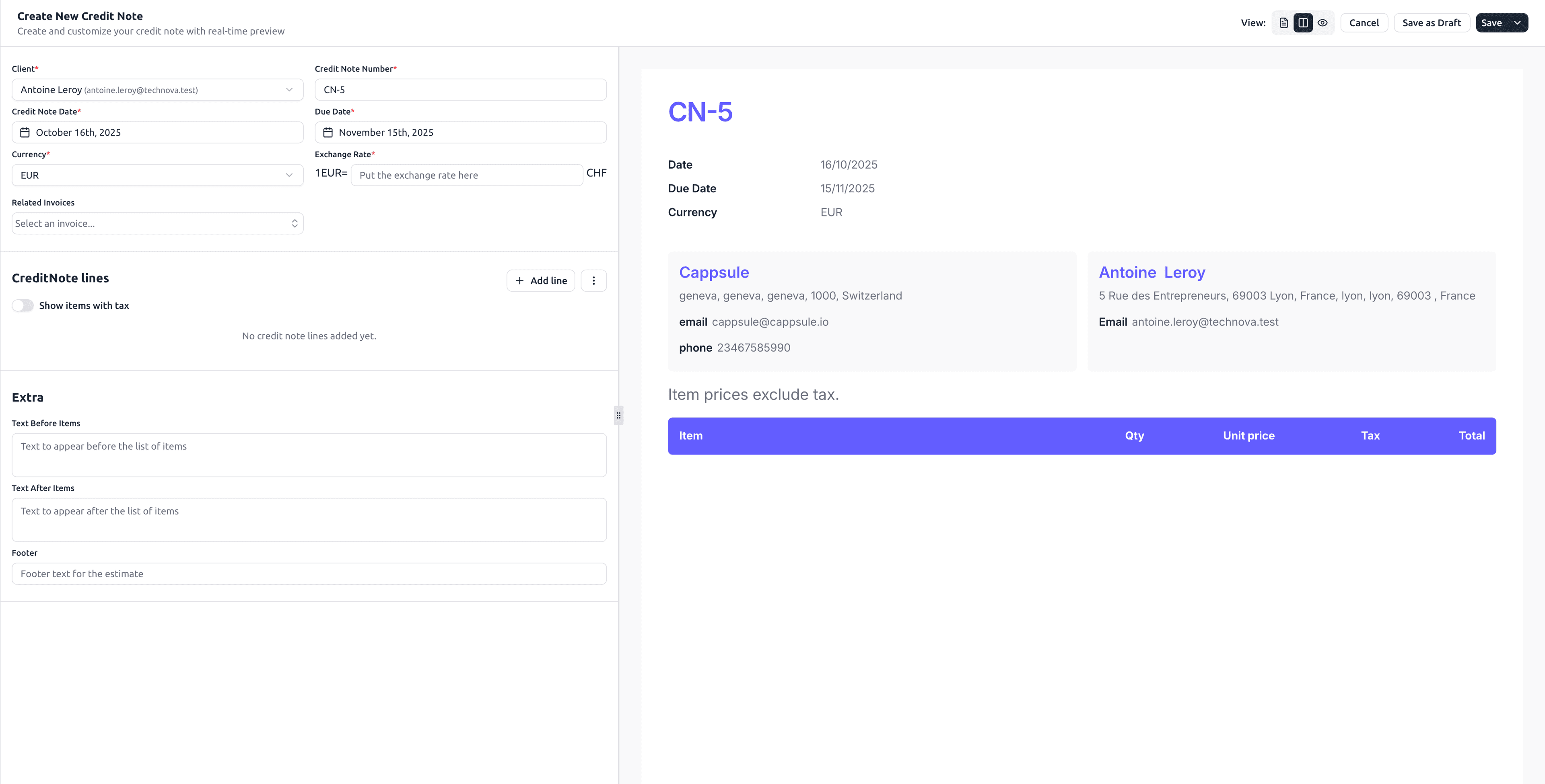

🗓️ Step 2: Fill Credit Note Details

Enter the key details to identify your credit note.

| Field | Description |

|---|---|

| Credit Note Number | Automatically generated or manually edited. |

| Credit Note Date | Date when the note is created. |

| Due Date | When the credit should be applied. |

| Currency | Select the currency used. |

| Related Invoice (optional) | Link this credit note to a specific invoice. |

Linking to an existing invoice automatically imports client and amount details for faster setup.

🧮 Step 3: Add Credit Lines

Click Add Line to list refunded or corrected items.

Each line includes:

- Item name or description

- Quantity

- Unit price

- Tax (optional)

Use the Show items with tax toggle if the refund includes tax adjustments.

Show items with tax: Determines whether item prices are entered and displayed as gross (with tax) or net (without tax). Totals are shown accordingly, and slight differences may appear due to rounding when conv

📝 Step 4: Customize Extra Fields

Under the Extra section, personalize your credit note.

| Field | Description |

|---|---|

| Text Before Items | Introductory message (e.g., “Refund due to duplicate charge”). |

| Text After Items | Additional explanation (e.g., “Applied as account credit”). |

| Footer | Legal or accounting details for reference. |

Example:

💬 “This credit note offsets invoice INV-001 issued on Oct 1, 2025.”

🧾 “Please contact info@cappsule.io for clarification.”

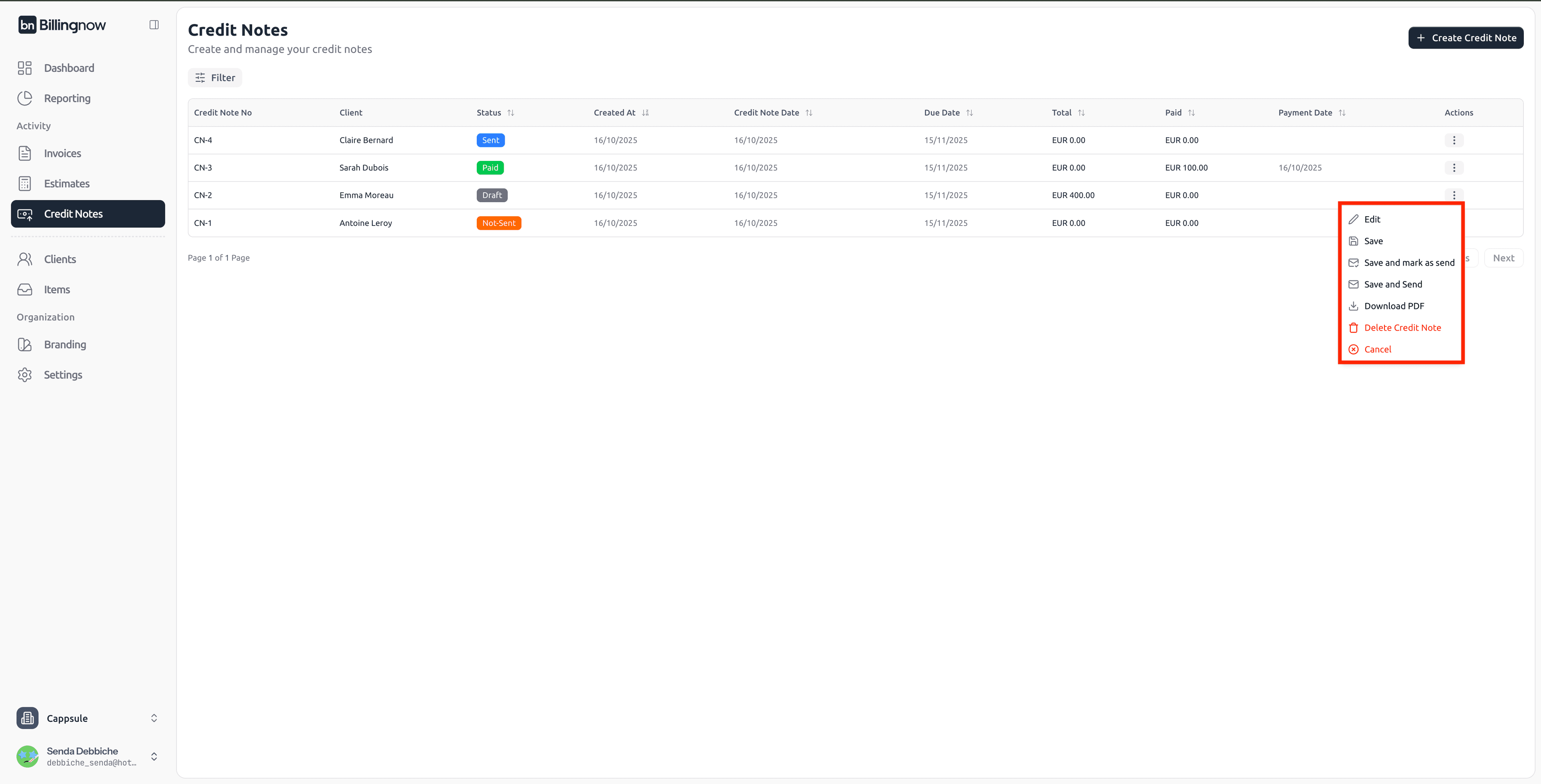

When finished, you can:

| Action | Description |

|---|---|

| Save as Draft | Keep editable for review. |

| Save (Not Sent) | Finalize the credit note but keep it as “Not Sent” status. |

| Send | Send the credit note via BillingNow’s email system. |

| Mark as Sent | Mark credit note as sent (for manual sending via your own email). |

| Download PDF | Download the credit note as PDF for manual distribution. |

| Edit | Modify the credit note details. |

| Delete Credit Note | Permanently remove the credit note from your system. |

| Cancel | Discard changes without saving. |

Always preview the credit note before saving. Once confirmed, the credit can automatically adjust the related invoice balance.

💌 Sending Credit Notes via Email

You can share credit notes with your clients in two ways:

1️⃣ Send Directly from BillingNow

Use the “Send” button to deliver the credit note automatically from the system. BillingNow will send a professional email to the client, including:

- The credit note PDF as an attachment

- The credit note summary (number, total, and due date)

- A short personalized message

Example of email preview:

Subject: Credit Note CN-2

Body:

Dear Mrs Emma Moreau,

Please find attached your credit note CN-2.

Thank you for your business.

Best regards,

Cappsule

Options:

- You can customize the subject and message body before sending.

- Once sent, the credit note status changes to Sent, and a timestamp is recorded in the dashboard.

- The client’s email address is automatically taken from their profile.

Make sure your client’s contact email is correct in the Client Details section to ensure successful delivery.

2️⃣ Send Manually from Your Personal Email

If you prefer to use your own mailbox (e.g., Outlook, Gmail):

- Click Download PDF on the credit note.

- Attach the downloaded file to your personal email.

- Write your own message and send it manually.

- After sending manually, return to the credit note and click Mark as Sent to update its status in BillingNow.

Email Sending Status

Once an email is sent from BillingNow:

- The status icon changes from 🟠 Not Sent to 🔵 Sent.

- The Sent Date column displays the exact timestamp.

- You can Resend the credit note anytime from the Actions menu.

💰 Step 5: Add Payment

Once a credit note has been sent to a client, you can record payments received:

Payments can only be added to credit notes with “Sent” status. Draft and “Not Sent” credit notes cannot receive payments until they are sent.

To add a payment:

- Select the credit note from your credit note list actions

- Click “Add Payment” button (available only for sent credit notes)

- Enter payment details:

- Reference

- Payment date

- Payment amount

- Payment method (Bank Transfer, Credit/Debit Card, Cash, Check, PayPal, Other)

- Save the payment

The credit note status will automatically update based on the payment:

- Partially Paid - If payment is less than the total amount

- Paid - If payment equals or exceeds the total amount

🔁 Applying Credit to an Invoice

If the credit note is linked to an invoice:

1️⃣ The amount will be deducted from the invoice total.

2️⃣ The invoice status will update to reflect the new balance.

3️⃣ Both documents remain linked for accounting traceability.

💡 Best Practices

✔ Always link credit notes to their original invoices when applicable.

✔ Use consistent numbering (e.g. CN-001, CN-002).

✔ Record the reason for each credit note in the footer for transparency.

✔ Export monthly reports to track refunds and corrections.