The Items module allows you to manage all your products and services in one centralized place.

Items are reusable across Invoices, Estimates, Credit Notes, and Bills, ensuring consistent pricing, tax application, and unit definitions throughout BillingNow.

With this module, you can:

- 📦 Create and manage products and services

- 💰 Define net and gross prices

- 🧾 Apply tax rates (VAT)

- 🔁 Reuse items across all billing documents

- 🔍 Filter, search, and export your item catalog

- 🟢 Activate or deactivate items without deleting them

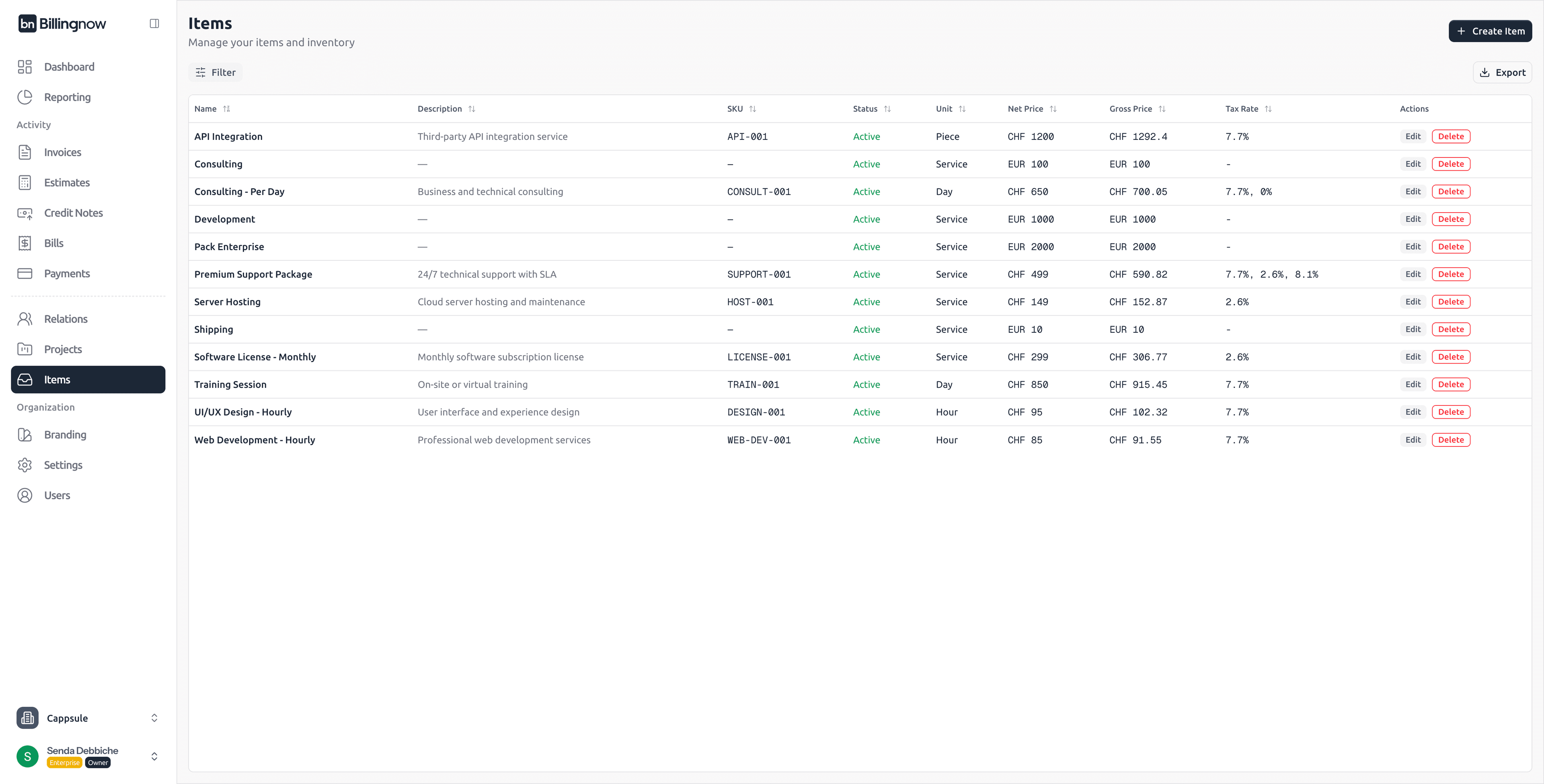

📂 Items Dashboard

Navigate to Sidebar → Items

The Items dashboard displays all existing products and services with their key information.

📊 Columns Overview

| Column | Description |

|---|---|

| Name | Name of the product or service. |

| Description | Short description of the item (optional). |

| SKU | Internal or external reference code (optional). |

| Status | Indicates whether the item is Active or Inactive. |

| Unit | Unit type such as Service, Piece, Hour, or Day. |

| Net Price | Item price before tax. |

| Gross Price | Item price including tax, based on selected VAT rates. |

| Tax Rate | Applied VAT rate(s). Multiple taxes may be applied if configured. |

| Actions | Edit or Delete the item. |

🟢 Edit – Update item information

🔴 Delete – Permanently remove the item from your catalog

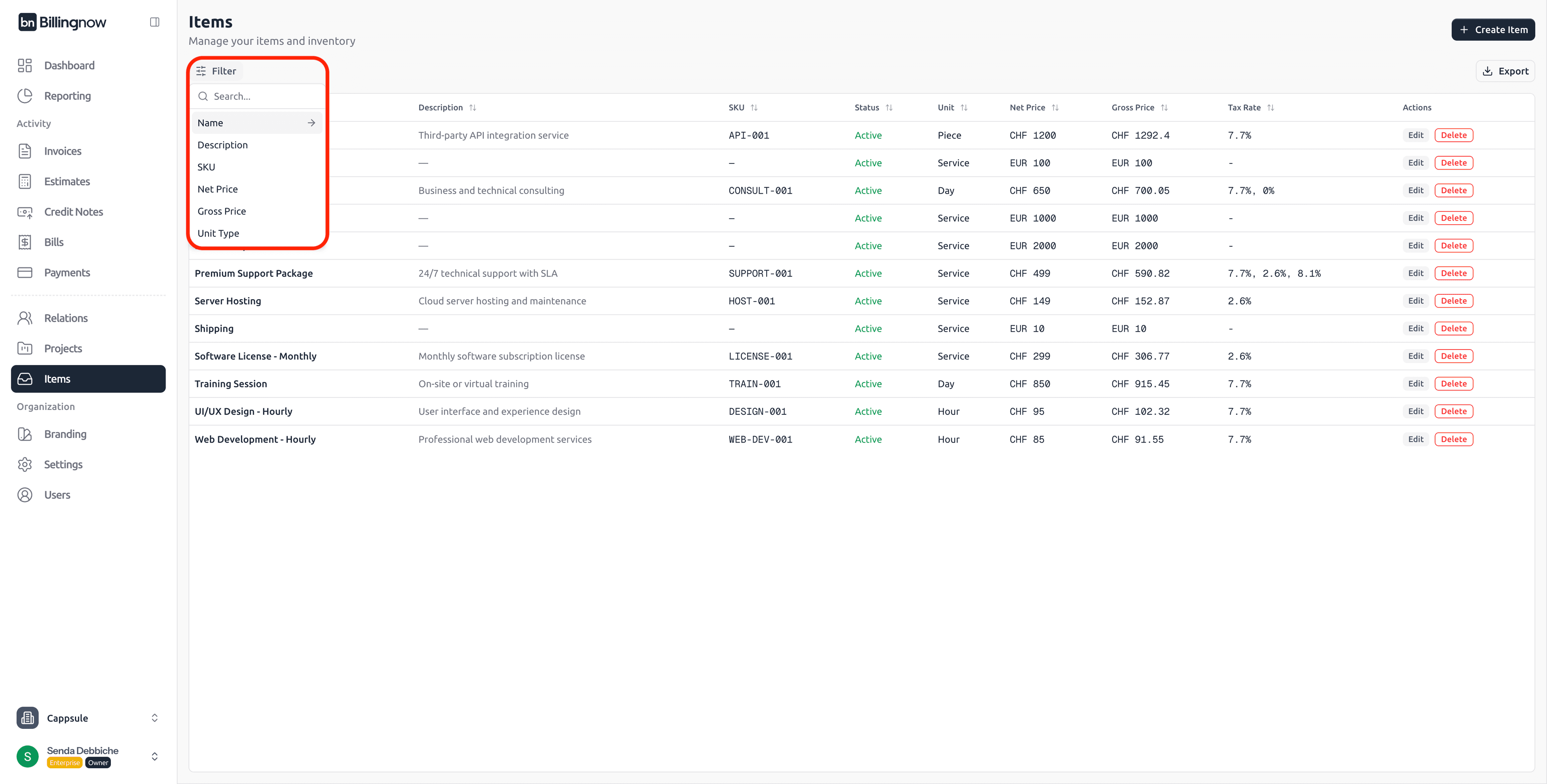

🔍 Filtering & Search

Click Filter to search and refine items in your catalog.

Available Filters

You can filter items by:

- Name

- Description

- SKU

- Net Price

- Gross Price

- Unit Type

Filtering is especially useful when working with large inventories or preparing invoices quickly.

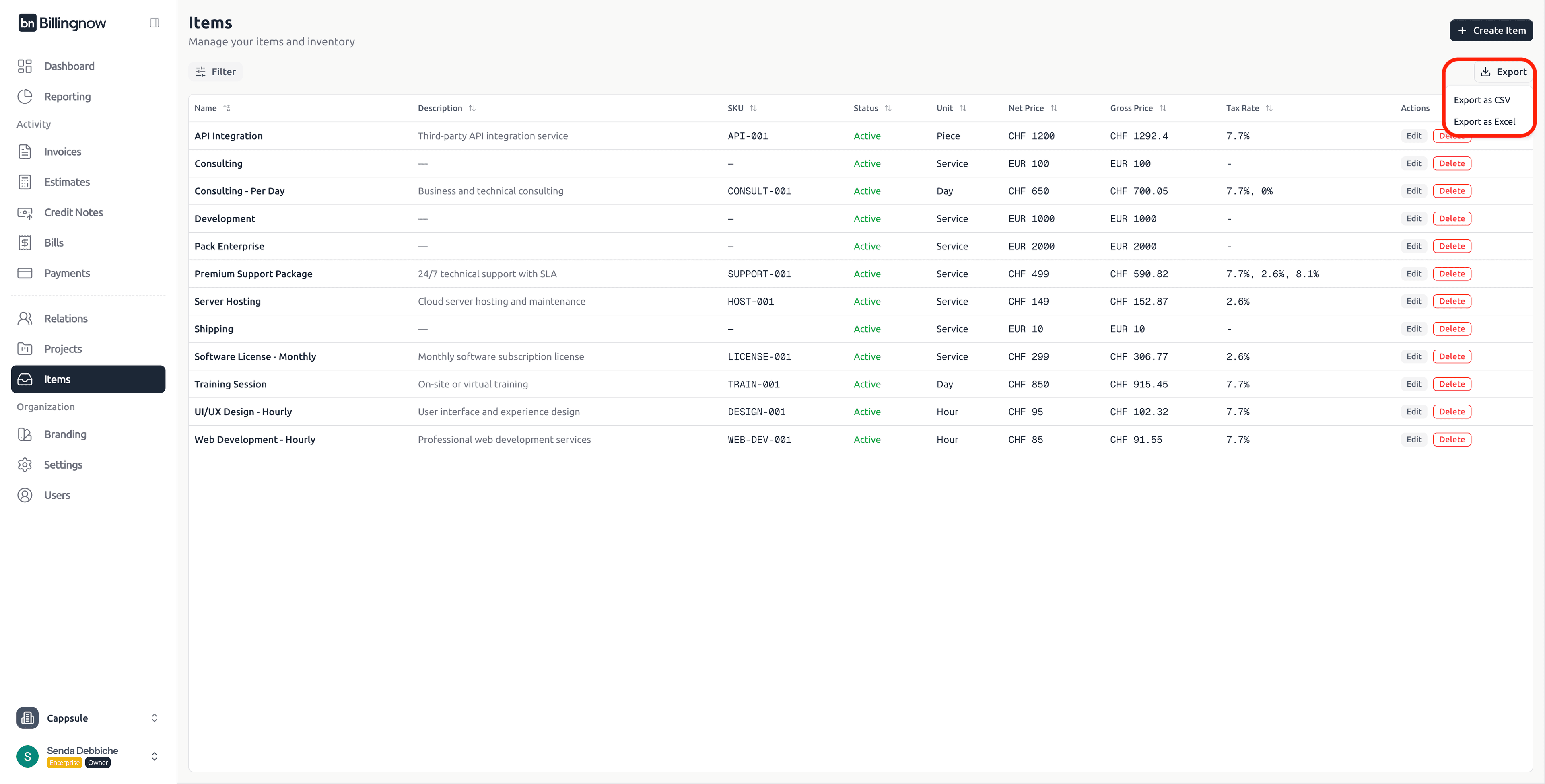

📤 Export Items

Click Export in the top-right corner of the Items page.

Available formats:

- Export as CSV

- Export as Excel

Exports reflect the currently applied filters.

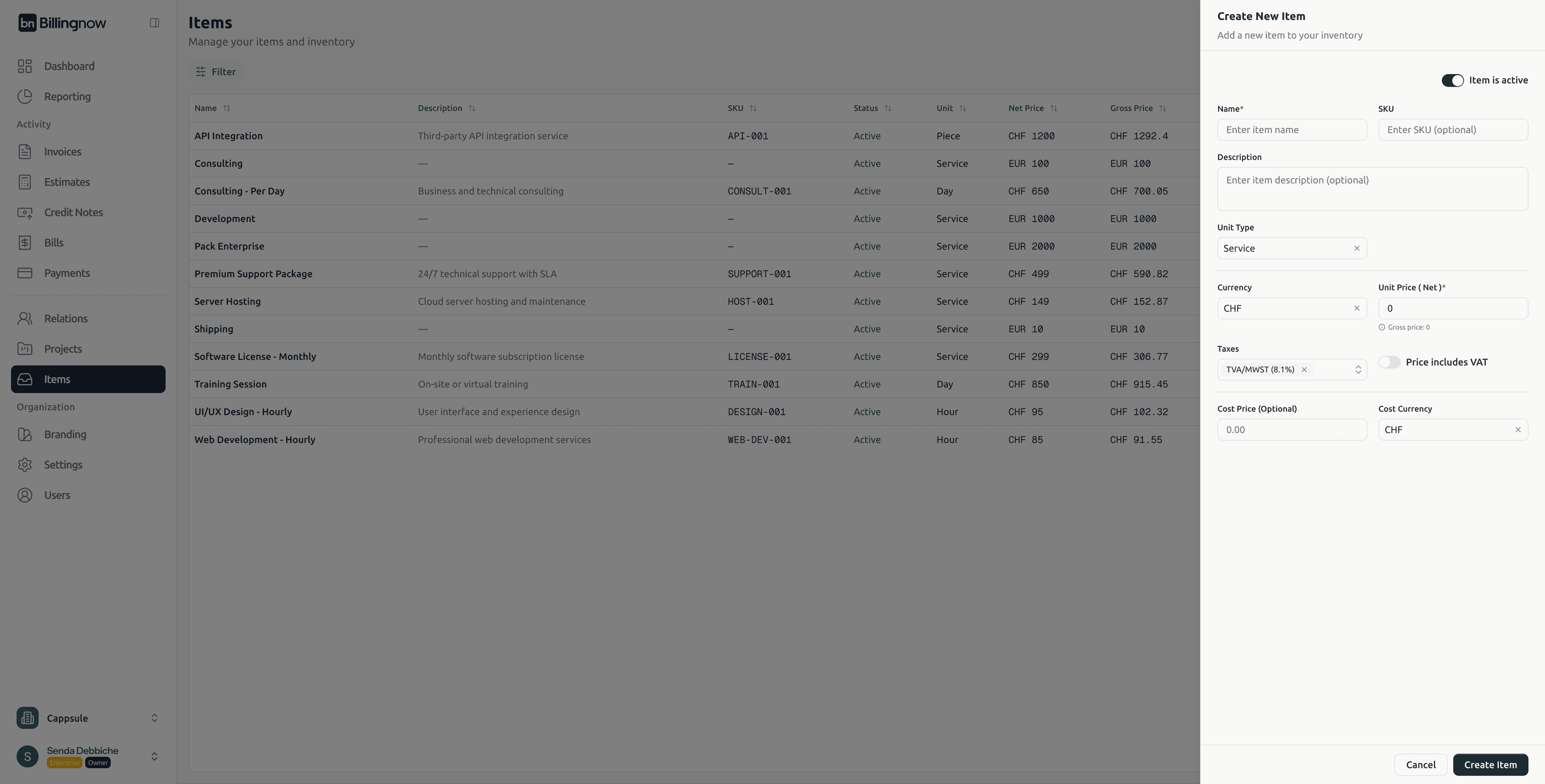

➕ Creating a New Item

Click Create Item to add a new product or service to your inventory.

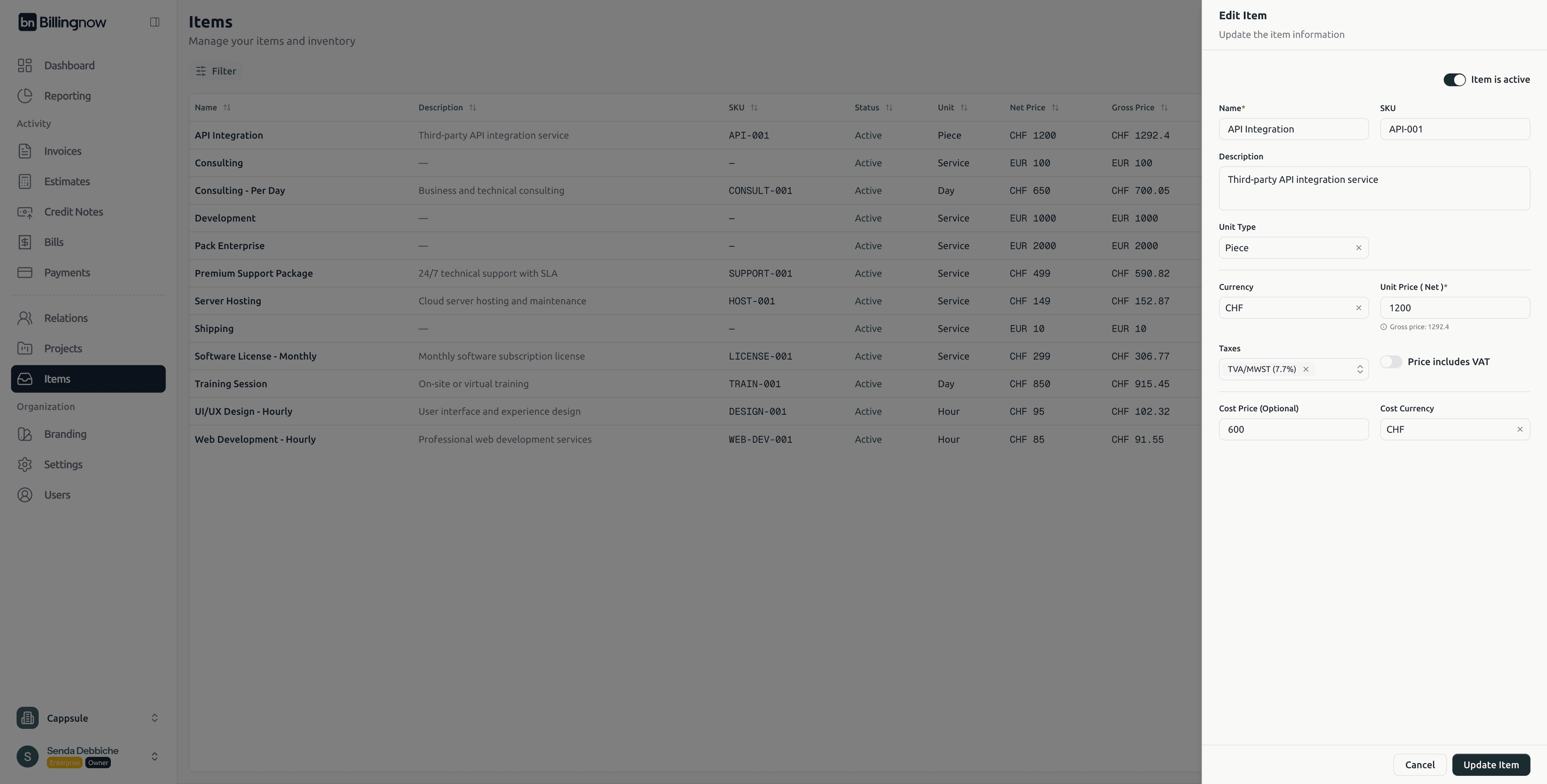

🧾 Item Information Fields

| Field | Description |

|---|---|

| Item is active | Toggle ON/OFF to activate or deactivate the item. |

| Name | Name of the product or service. (Required) |

| SKU | Internal or external reference code. (Optional) |

| Description | Additional item details. (Optional) |

| Unit Type | Defines how the item is billed (Service, Piece, Hour, Day…). |

| Currency | Default currency used for the item price. |

| Unit Price (Net) | Price before tax. |

| Taxes | One or more VAT rates applied to the item. |

| Price includes VAT | Toggle ON if the entered price already includes VAT. |

| Cost Price (Optional) | Internal cost of the item (used for margin analysis). |

| Cost Currency (Optional) | Currency used for the cost price. |

The gross price is calculated automatically based on the selected tax rates.

Click Create Item to save.

The item becomes immediately available in invoices, estimates, credit notes, and bills.

✏️ Editing an Item

To edit an existing item:

- Click Edit next to the item

- Update pricing, tax, description, unit, or status

- Click Update Item to save changes

Changes apply to future documents only.

Existing invoices, estimates, or bills remain unchanged.

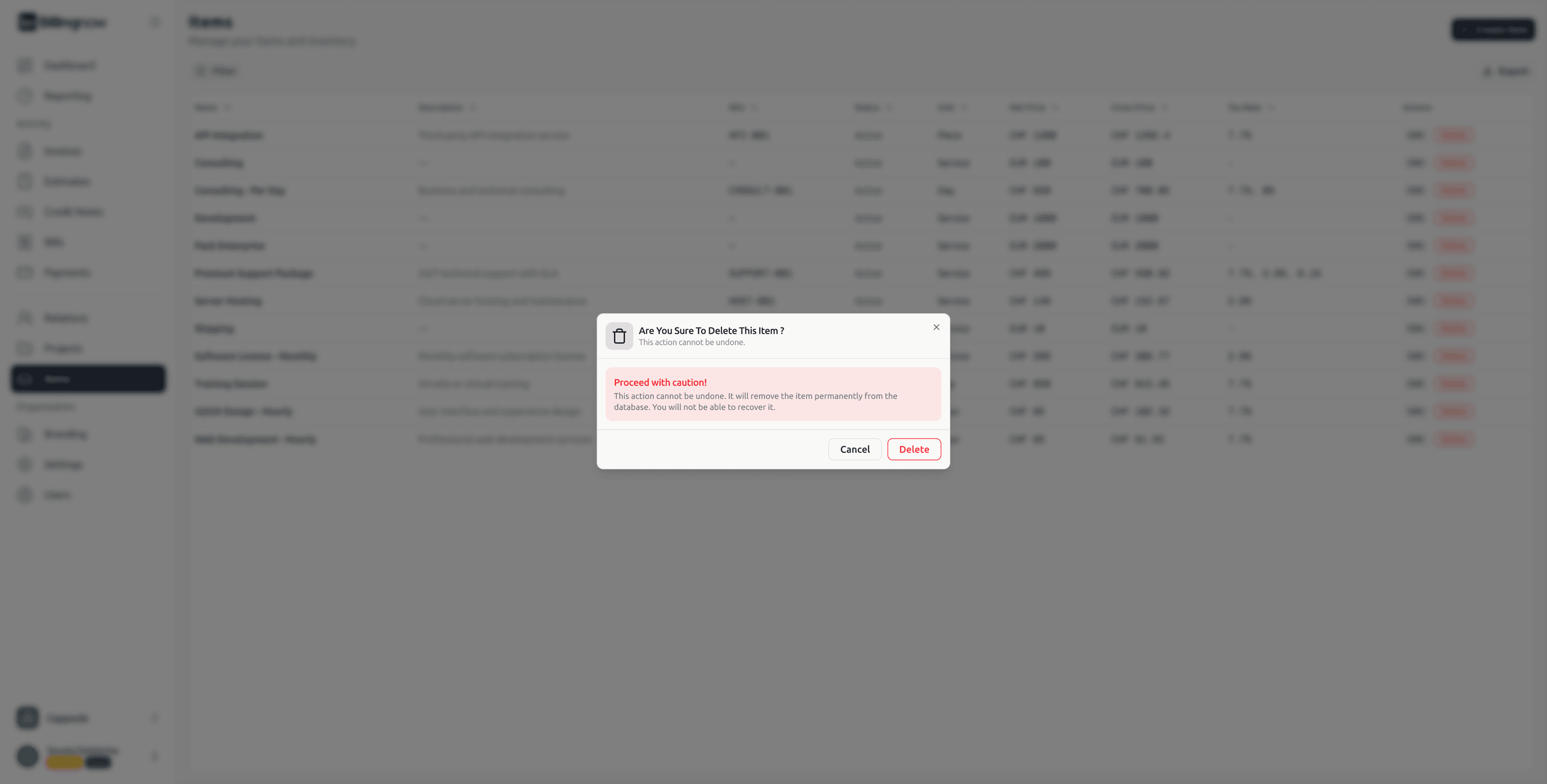

🗑️ Deleting an Item

To permanently remove an item from your catalog:

- Click Delete next to the item

- Confirm deletion in the warning modal

This action is irreversible.

Once deleted, the item is permanently removed and cannot be recovered.

🟢 Active vs Inactive Items

Instead of deleting an item, you can deactivate it using the Item is active toggle.

- Active items

- Available for selection in all billing documents

- Inactive items

- Hidden from selection

- Still preserved for historical records

Deactivating items is recommended when a product or service is no longer sold but must remain for audit or reporting purposes.

🔁 Usage Across BillingNow

Items are reused automatically in:

- 🧾 Invoices

- 📑 Estimates

- 💳 Credit Notes

- 🧾 Bills

This guarantees pricing consistency, tax accuracy, and unit alignment across all modules.

💡 Best Practices

✔ Use clear and descriptive item names

✔ Prefer deactivating items instead of deleting them

✔ Keep tax rates up to date for compliance

✔ Use SKUs for exports and accounting integration

✔ Review prices regularly to avoid discrepancies

✅ Summary

This documentation reflects the latest Items module, including:

- Filtering & export

- VAT-inclusive pricing

- Net vs gross price calculation

- Active/inactive item lifecycle

- Safe deletion workflow

- Cross-module reuse