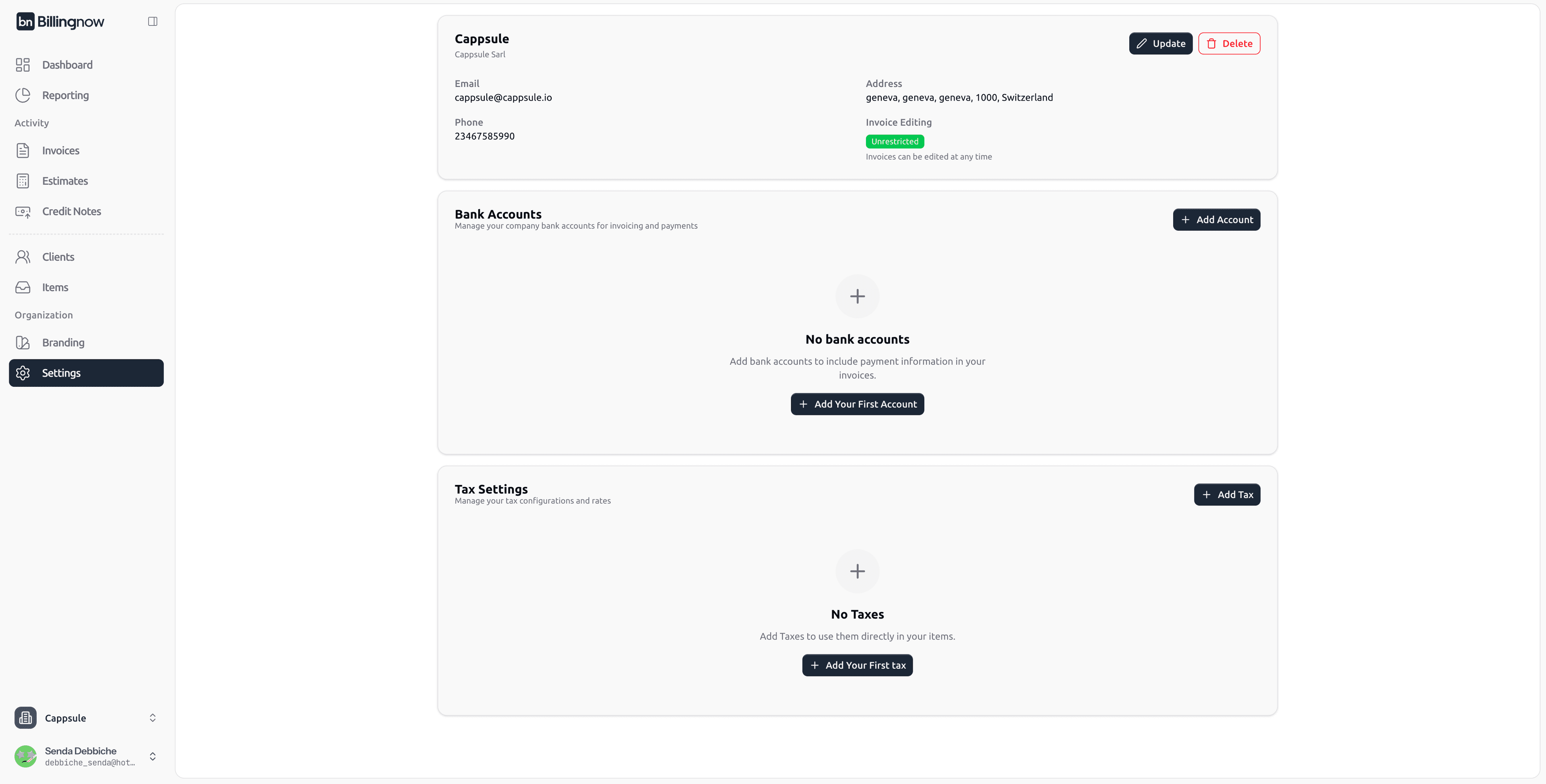

The Settings module allows you to define the foundational information for your company within Billing Now.

From here, you can:

- Update company details (name, contact info, address, etc.)

- Add and manage bank accounts

- Create and configure tax rates

🏢 Company Information

This section contains your company profile and contact details used across invoices, estimates, and credit notes.

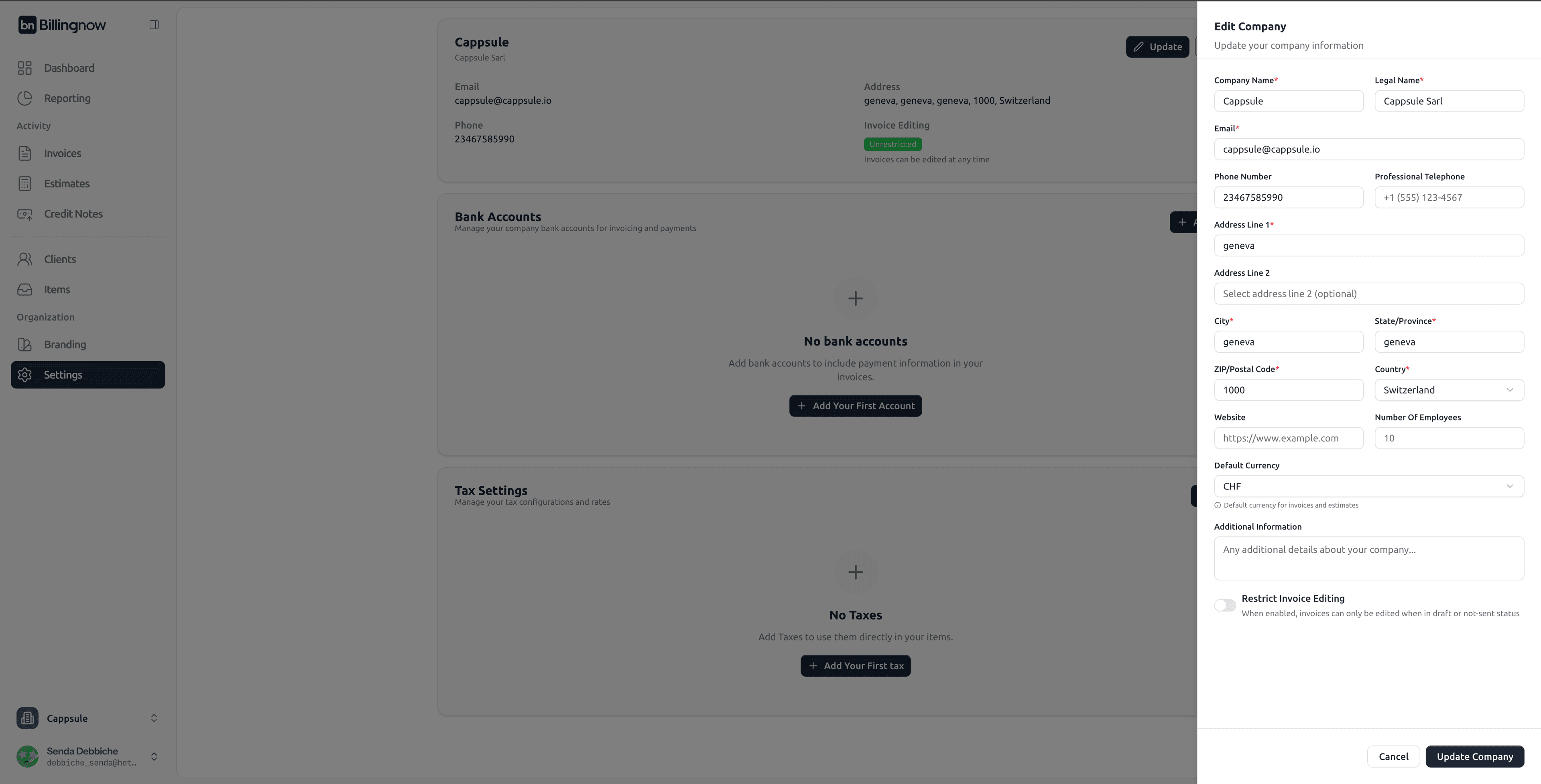

| Field | Description |

|---|---|

| Company Name | The display name of your company in documents. |

| Legal Name | The legal entity name. |

| Company contact email. | |

| Phone Number | Default phone number shown on invoices. |

| Professional Telephone | Optional secondary contact. |

| Address Line 1 / 2 | Company address. |

| City / State / ZIP / Country | Complete location data. |

| Website | (Optional) Company website. |

| Number of Employees | For internal reference. |

| Default Currency | Default currency for all financial documents. |

| Restrict Invoice Editing | Toggle to allow/disallow invoice modification after sending. |

✏️ Editing Company Info

- Click Update at the top-right of the company card.

- Edit your company details in the form.

- Click Update Company to save.

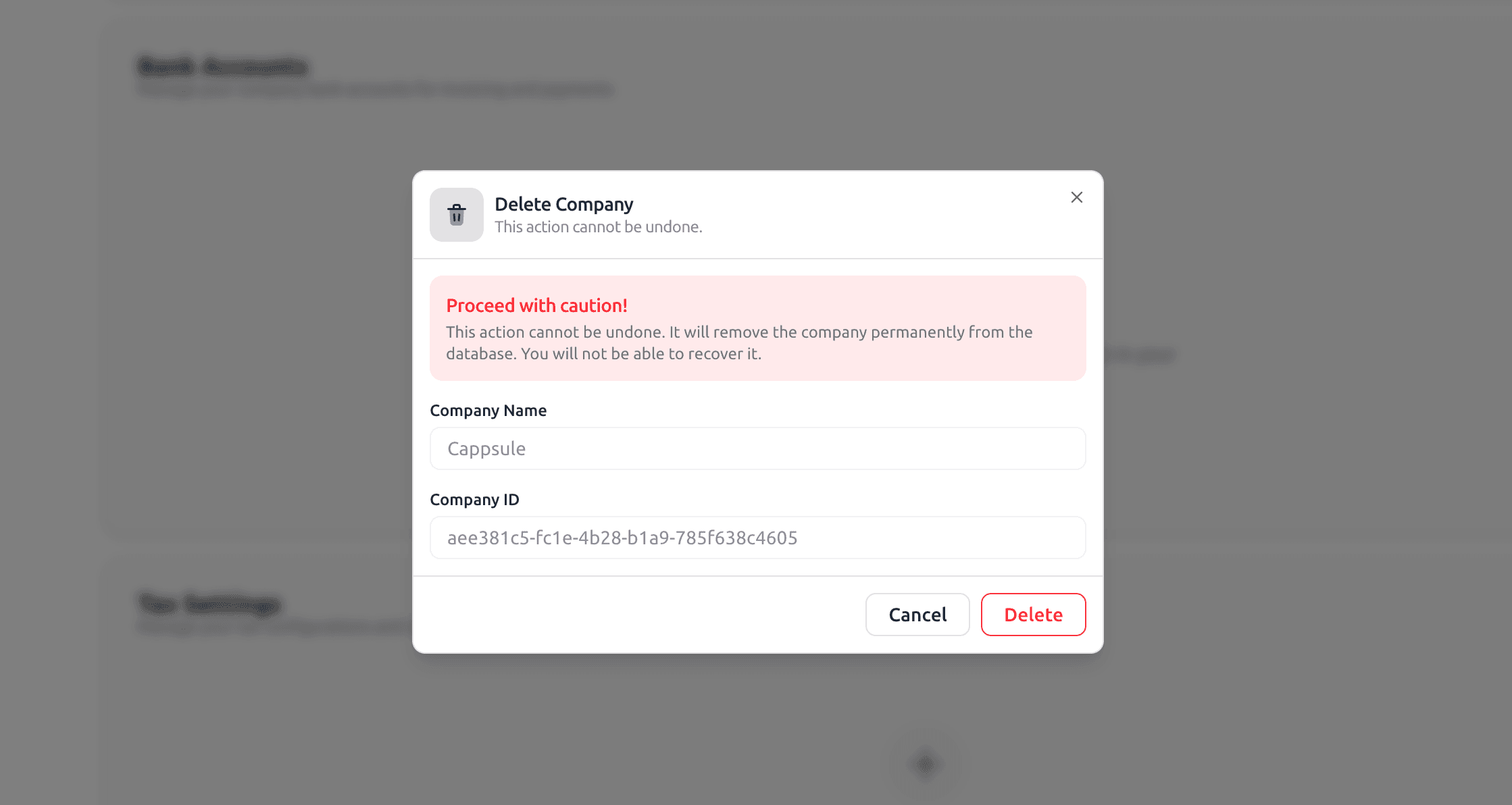

🗑️ Deleting a Company

Click Delete, confirm by entering your company name and ID, then validate.

⚠️ Caution: This action is permanent and cannot be undone.

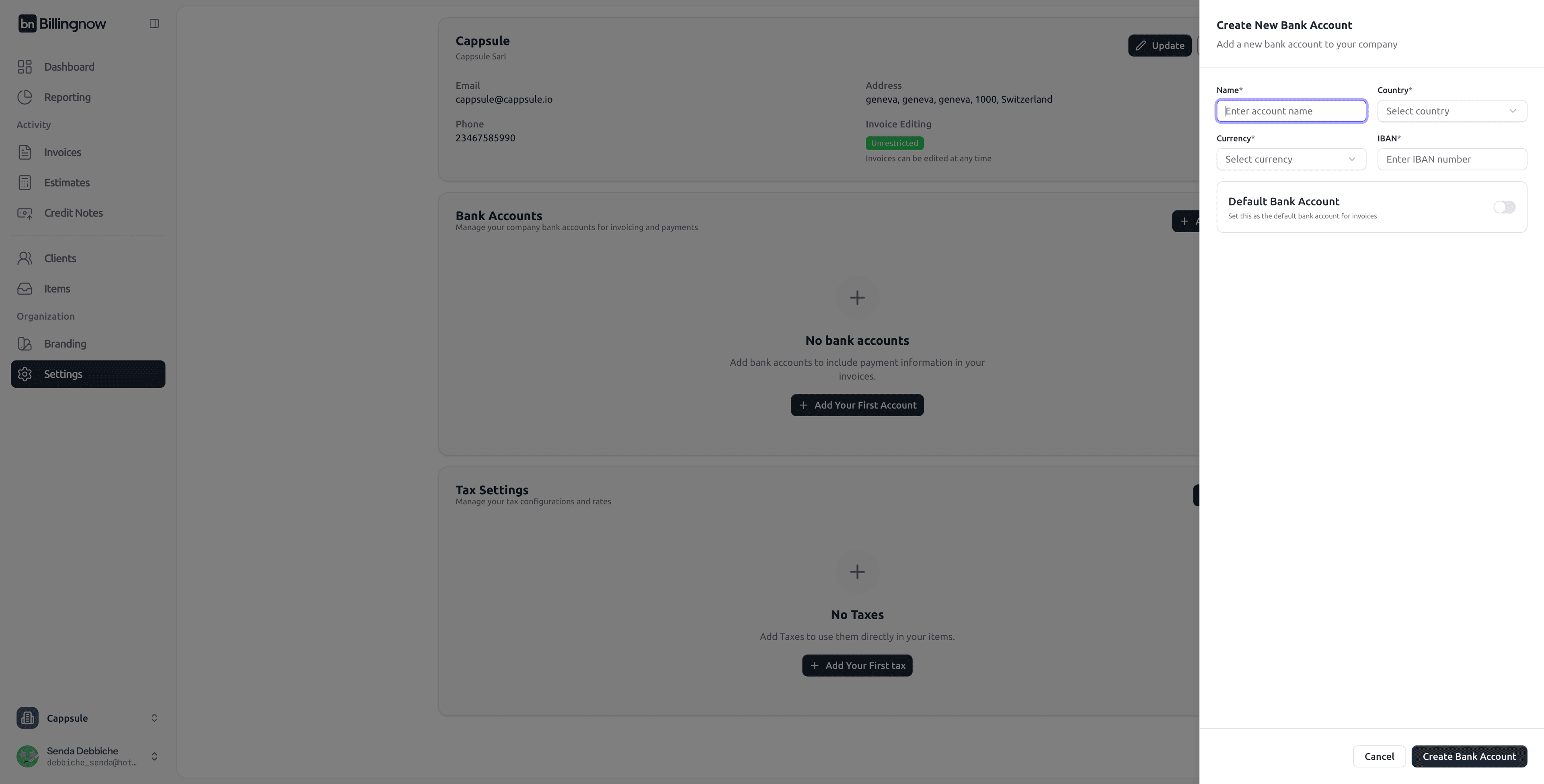

🏦 Bank Accounts

The Bank Accounts section stores company bank details used for payments and displayed on invoices.

| Field | Description |

|---|---|

| Name | Account name (e.g., Main Business Account). |

| Country | Country where the bank is located. |

| Currency | Currency of the account. |

| IBAN | International Bank Account Number. |

| Default Bank Account | Marks this account as the default one for invoices. |

➕ Adding a Bank Account

- Click Add Account or Add Your First Account.

- Fill in the required details.

- Click Create Bank Account to save.

You can manage multiple bank accounts and assign one as the default for outgoing invoices.

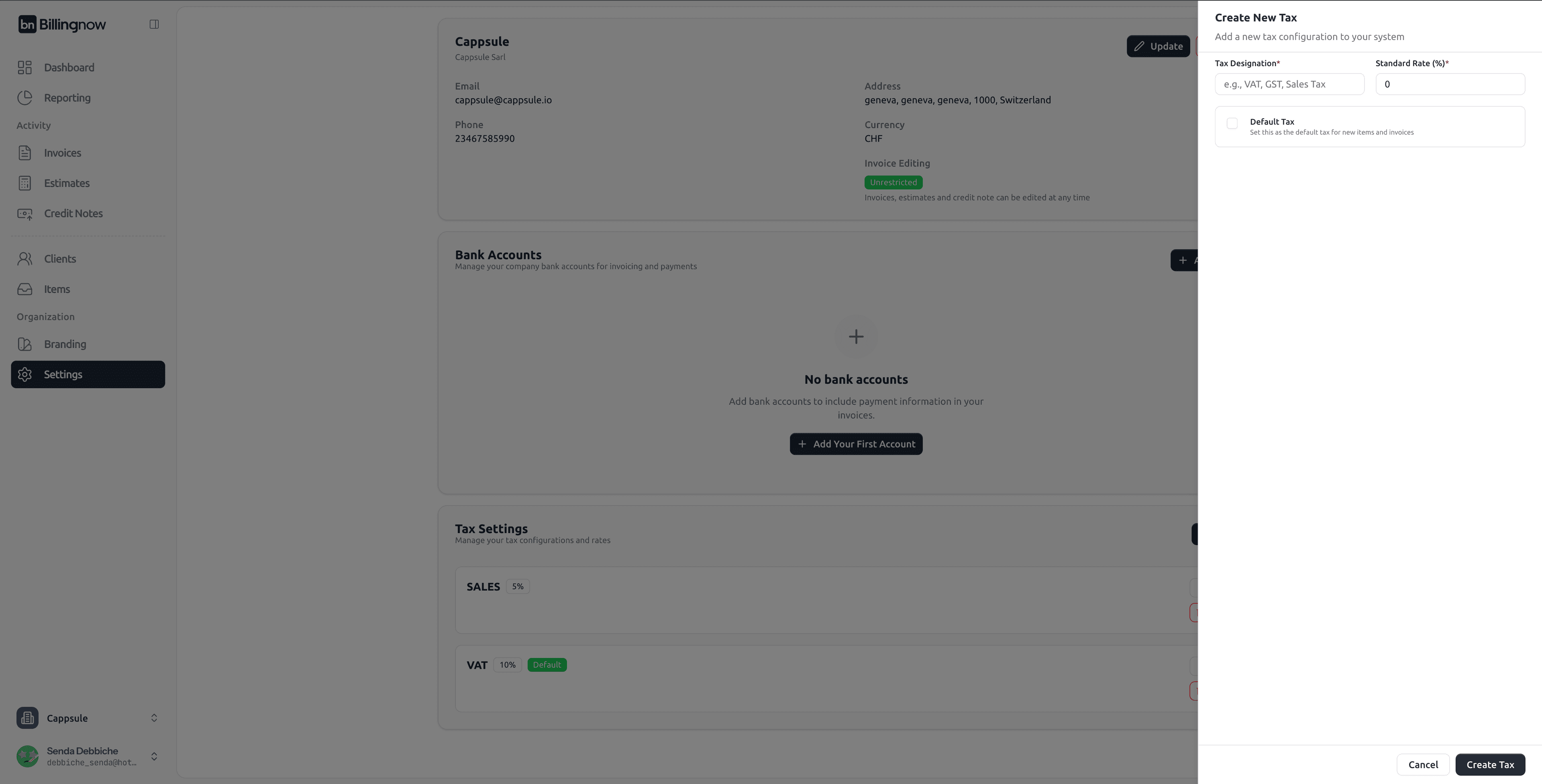

💰 Tax Settings

This section helps define applicable tax configurations for your company.

| Field | Description |

|---|---|

| Tax Designation | Name of the tax (e.g., VAT, GST, Sales Tax). |

| Tax Rate (%) | Percentage rate applied to invoices and items. |

| Default Tax | Marks this tax as the default for all new documents. |

➕ Adding a Tax

- Click Add Tax or Add Your First Tax.

- Enter the tax name and rate.

- Toggle Default Tax if it should apply by default.

- Click Create Tax.

You can add multiple tax types if your organization operates in several countries.

💡 Best Practices

✔ Keep company and bank details up to date to avoid errors in invoices.

✔ Define a default currency and tax rate early for consistency.

✔ Use clear naming for bank accounts to distinguish between local and international ones.

✔ Regularly review your tax settings if your business operates in multiple jurisdictions.